Simplifying Tax Planning for Small Businesses

Key Takeaways

- Effective tax planning can significantly reduce a small business’s tax burden.

- Learning simple tax-saving strategies can improve financial health.

- Online resources and tools can assist in tax compliance and optimization.

Effective tax planning serves as a crucial pillar in the financial health of small businesses, potentially enhancing profitability and promoting sustainability. Small enterprises can focus on growth and competitiveness by effectively managing their tax obligations. Many businesses turn to small business CPA solutions to simplify and optimize their financial management processes. Engaging with specialists can make fulfilling tax obligations less burdensome, ensuring businesses remain compliant while freeing up resources for other critical operations.

Though the tax landscape may seem intimidating, mastering a few fundamental strategies can lead to significant savings. Through diligent planning and the use of the right tools and resources, businesses can transform tax season from a source of stress into an opportunity for financial optimization. Let’s explore a comprehensive set of strategies designed to streamline tax planning for small businesses.

Introduction to Tax Planning for Small Businesses

Many small business owners find the complexity of tax laws to be a significant hurdle. Without a clear understanding of tax obligations, businesses run the risk of financial mismanagement and unnecessary tax liabilities. However, with informed tax planning, the complexities can be untangled, offering a strategic advantage that promotes fiscal health and compliance. This preparation ensures adherence to legal requirements and optimizes financial returns, setting the stage for business growth.

Essential Tax Planning Strategies

Starting tax planning early puts businesses in a position to take proactive steps toward minimizing their tax burdens. One effective strategy is the strategic deferral of income and prepayment of expenses, which can help manage taxable income levels. Businesses should also stay informed about new tax laws and allowances, adjusting their strategies accordingly. By anticipating tax liabilities and making informed decisions, businesses can better allocate resources throughout the fiscal year. For those seeking further guidance, the IRS’s small business tax guide offers a comprehensive overview of strategies and considerations.

Common Tax Deductions for Small Businesses

Maximizing tax deductions is a cornerstone of smart tax planning. Common deductible business expenses encompass travel expenses, equipment purchases, and office supplies. Beyond these standard categories, businesses often overlook other eligible deductions like the costs associated with using a home office or premiums paid on health insurance. Understanding and applying these deductions can substantially reduce taxable income.

Tools and Resources for Effective Tax Management

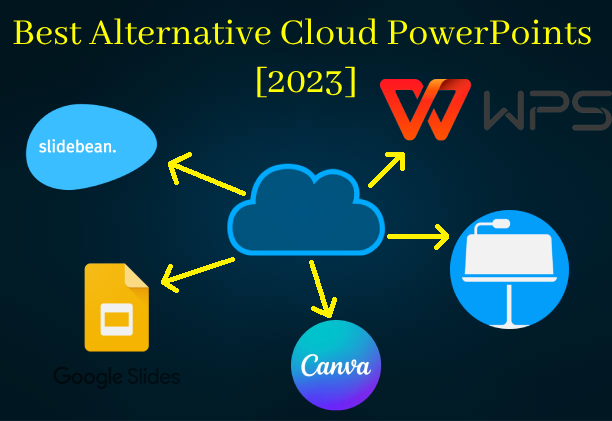

The efficiency of modern tax management tools can significantly ease the administrative burden on small businesses. Automated software solutions enable precise tracking and analysis of finances, facilitating accurate tax preparation. Cloud-based services offer flexibility, accessibility, and security, which are essential for businesses that may not have a dedicated financial team. Additionally, using online calculators and tools aids in forecasting and strategizing future tax liabilities, making it easier to plan budgets effectively and reduce risk.

Importance of Record Keeping

Good record-keeping goes beyond compliance, acting as a vital tool for financial insight and risk management. Accurate records provide a clear picture of financial health, enabling more informed decision-making. Digitizing records ensures easy retrieval and reduces the potential for loss or mismanagement of important documents. Regular updates to bookkeeping practices can uncover hidden inefficiencies and provide opportunities for claiming additional deductions, ultimately maximizing business profitability.

Engaging with Tax Professionals

Consulting with tax professionals can provide businesses with targeted advice that considers their unique circumstances. A CPA or tax advisor can offer insights into complex tax codes, helping to identify applicable credits and deductions that business owners might overlook. With their guidance, businesses can focus on strategic growth rather than navigating through the complexities of tax regulations. Careful selection of a qualified professional should consider their experience, reputation, and understanding of your specific industry to ensure the best outcomes.

Benefits of Regular Tax Reviews

Regular tax reviews enable businesses to stay ahead of new tax legislation and adapt their strategies to ensure financial efficiency. The insights gained from these reviews are crucial for optimizing tax positions and spotting opportunities to reduce liabilities. Each review presents a chance to reassess ongoing financial practices, helping businesses stay agile and informed. Timely reviews lead to better alignment of business objectives with tax obligations, fostering a proactive rather than reactive approach to financial management.

Optimizing Business Structure for Tax Efficiency

The choice of business structure directly impacts tax obligations and savings opportunities. Whether operating as a sole proprietor, partnership, LLC, or corporation, each model presents different tax implications. By understanding these nuances, businesses can potentially restructure to benefit from favorable tax treatments. Such structural optimization often results in increased profitability and competitiveness, as it helps businesses align their operational model with their financial goals, ultimately reducing their overall tax burden.

You may also read: Versatility and Benefits of 1031 Exchanges in Real Estate Investing

By embracing these strategic aspects of tax planning, small businesses can navigate the complexities of taxes with greater confidence and efficacy. This not only helps with compliance but also boosts the financial health and long-term viability of the business.