Financial Advice Services Every Investor Needs

Investing in almost anything can be very intimidating for many people, especially those who have never done it before or whose knowledge concerning finance and its operations is not sound. Receiving comprehensive financial advice services equips you with guidance in making educated investment decisions. Investing in the right mortgage advisor in Sydney can help secure your financial future. The first step in any financial advice service understands your unique financial goals. The identification of these objectives will enable the advisor to create an individualized plan. Here are key financial advice services every investor should consider getting from a financial advisor.

Risk Management and Diversification

One of the most essential aspects of sound investment advice relates to risk management. Financial advisors guide the client in relation to the complexities of risk, identifying where opportunities for high returns can be taken with the use of more conservative, safety-oriented investments. Such diversification is among the most significant strategies an advisor is in a position to employ to help you manage risks. This includes diversification of the investments across asset classes to make sure that no single market fluctuation places a dent in your overall portfolio. Over a number of years, the advisor will oversee the portfolio to institute those adjustments necessary to maintain an ideal ratio between risk and reward over time.

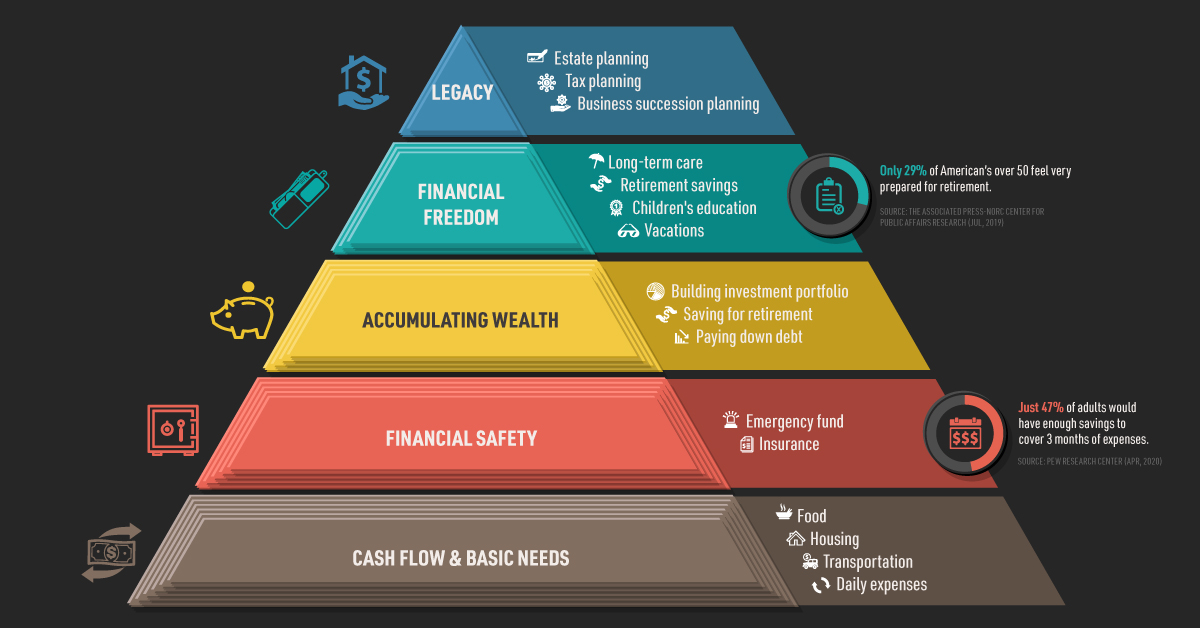

Wealth Building Strategy in a Long-Term Investment

The ultimate goal of long term investment is wealth building. Another most essential step in long term financial investment is building wealth. Long-term investment strategies are one of the main areas of focus for comprehensive financial advice services. Advisors will often advise clients to be patient in building their wealth, using only investment vehicles that could logically appreciate over time. Such investments may come in different forms, ranging from retirement plans, mutual funds, or real estate investments. Provided clients are not deviating from making impulsive decisions from market fluctuations; they can often realize more consistent portfolio growth.

Tax and Legal Compliance

An equally important aspect of investment guidance is that of tax efficiency and legal compliance. Clients working with financial advisors are able to make the most of available tax-saving opportunities. They also keep clients informed on issues relating to legal compliance about investments. Suppose one has to assist a client in understanding the tax implications of capital gains or international investments. An adviser who is experienced in the field will be in a position to maximize your portfolio, minimize tax burdens for you, and keep you within the bounds of the law currently in place.

Retirement Planning and Estate Management

The ultimate goal of investment for most is retirement planning. Financial advisors work with their clients to develop a sustainable retirement plan that must balance income, expenses, and possible healthcare costs in the future. The other critical service concerning wealth management involves estate management, helping the client manage one’s assets to ensure adequate distribution to future generations. An advisor can assist in drafting wills, establishing trusts, and arranging for the assets to be distributed according to the wishes of the client while reducing the amount of estate taxes to a minimum.

Investments may come in different forms. Comprehensive financial advisory services are one of the strong pillars of support for getting the right match between an individual’s vision of the future and effective investment planning. In fact, right from goal identification to risk management and optimizing tax efficiencies down to retirement planning, the right mortgage advisor in Sydney will walk you through every step of your investment cycle. Be confident in partnering with a knowledgeable advisor to offer some peace of mind, knowing your finances are managed correctly to meet your short and long-term objectives. Make suitable investments today to secure your future.