M&A Evolution Virtual Data Rooms Redefining Future Deals

Mergers and acquisitions, commonly known as M&As, are highly complex and time-consuming business transactions. They require meticulous planning and efficiently organized execution to obtain desired results. According to research, 70%-90% of M&A transactions fail, while lack of communication and poor due diligence stand among the top 10 reasons for these failures.

However, thanks to modern-day virtual data rooms, decision-makers can save their time and money by making more informed decisions. Virtual data room software provides an all-in-one platform for buyers, sellers, facilitators, and other parties involved in mergers and acquisitions.

Let’s take a look into how data room technology is shaping the M&A industry.

M&A Data Rooms Defined

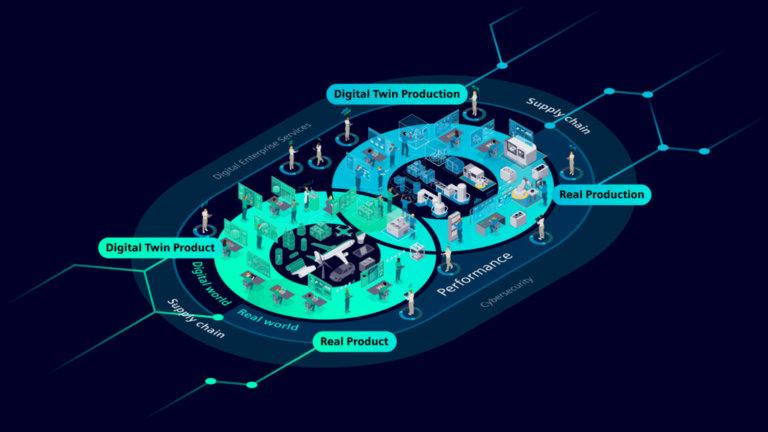

M&A dataroom, or virtual data room, is a digital, cloud-based data management solution that allows safer, faster, and real-time data sharing. In broader terms, an M&A data room acts as a central hub where all concerned parties can perform any activity related to an M&A transaction.

That said, online data room users can share massive volumes of information, assign tasks during the transaction, communicate in groups or privately, arrange group meetings, analyze data, assess buyers’ behavior, and whatnot.

Virtual Data Rooms—Shaping M&A Industry

Data room technology is streamlining M&A deals and reducing transaction time by a huge margin. Here is how data rooms make M&As more efficient.

1. Regulatory Compliance

One major reason for using a virtual data room for M&As is that it addresses all the regulatory compliance concerns. Businesses or deal makers must ensure that the data-sharing medium used in the transaction must comply with standards set by a concerned regulatory body.

For instance, data-sharing platforms operating in the European Union should comply with GDPR. Similarly, data-sharing platforms used in the US financial industry must be FINRA-compliant.

Using a high-end virtual data room ensures that dealmakers don’t have to worry about these issues. However, it is important to choose virtual data room providers that are certified by concerned regulatory bodies. You can also read more about some of the best M&A virtual data room solutions at https://dataroomreviews.org/data-rooms-for-ma/.

2. Data Protection

Cybersecurity has been one of the biggest challenges in M&A, especially when third parties have access to sensitive information. Online data rooms provide strong cybersecurity to protect confidential information during sensitive transactions like mergers and acquisitions.

VDRs protect against growing cyber threats such as phishing, viruses, and hacking. Companies can ensure their data is safe from unauthorized access—thanks to data rooms.

These platforms use robust security features like strong username and password controls, two-factor authorization, end-to-end encryption (SSL), and document encryption.

What’s more. watermarking documents adds another layer of protection, which prevents unauthorized copying or printing of sensitive files. Dataroom software helps protect against data leaks that could lead to financial and reputational damage.

In a nutshell, data room providers employ best cybersecurity practices to ensure that confidential business activities like mergers and acquisitions are fully secure.

3. Effortless Data Access and Sharing

One of the biggest achievements for data room vendors is that they have made cross-border deals easier than ever.

Data rooms are cloud-based technology which means you can access a VDR from anywhere anytime. That means people from both sides have instant access to data in a cross-border M&A.

Not only this, but a virtual data room makes the data access or retrieval process as simple as you like. For example, you can find or retrieve any file by simply typing a keyword or a sentence in the search bar.

On the other hand, high-end M&A data rooms come with due diligence checklists. These checklists allow sellers to upload and organize their deal data in the recommended manner.

Users in the data room can share tens and hundreds of files with one or more users in no time. Most importantly, they can also revoke access from a particular user or group of users at any time.

4. Efficient Data Analysis and Deal Transparency

VDRs have made data analysis easier. High-end virtual data rooms provide you with detailed audit reports that allow you to assess buyers’ activities and interest levels.

For example, you can see how much time a buyer spends reviewing your company data. This helps scrutinize interested and uninterested buyers.

Apart from that, you can also evaluate what type of documents a particular buyer accesses mostly. For instance, if a buyer is interested in reviewing financial statements, sellers can make sure they have easy access to all financial statements with ease.

The biggest advantage of audit reports is that they bring transparency. Every action performed by every user is recorded in the audit logs. This not only keeps things transparent for the sellers but for investors and other stakeholders as well.

Summing it up

Virtual data room technology has become a core element in the M&A industry. It ensures maximum data protection during voluminous data sharing in M&As and addresses compliance concerns. Data rooms make communication, data sharing, data organization, and data analysis ridiculously easy. Last but not least, VDRs keep everything transparent.