Private Equity Firms: Role, Function, and How It Works

Private equity firms deal with a variety of clients, taking their money if they want the PE firm to manage and check the business. These firms then accumulate the funds and create capital, which they can invest in a company or buy a stake in a market’s businesses.

This firm’s modus operandi is to bet on certain sectors or industries, which allows the business to get a capital infusion and is a major source of putting a startup or an early venture in the growth phase with the inclusion of capital in those businesses. These Pes also work with tax law firms from Los Angeles or its places of origin to navigate the legal boundaries.

In this blog, we will look into some of the most prominent things about a PE firm and how it operates. We will discuss its role in the modern capital market, its involvement in it, and the strategies it adopts in the process.

Understanding the Patterns of the Private Equity Firms and Its Types

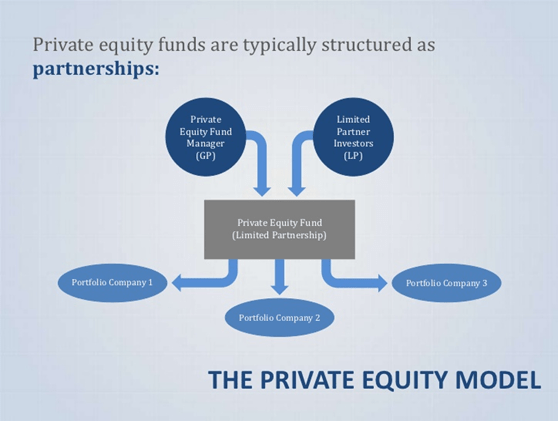

When it comes to PE firms, it’s a way or entity through which a person can club the capital in a private equity firm. The firm can use businesses where the CIO of the firm can invest the money and thus generate substantial returns for the investors.

1. PEs for Leveraged Buyouts

The most common form of a leveraged buyout is that it allows a PE to buy a company or valuable business with the help of a debt, and then the debt gets transferred to that company, which needs to pay back the debt as per the issue of the debt term.

2. A Growth Based Private Equity

The next is the growth capital of the PE firm, and they are using the fund to invest in companies that are used to grow and have growth potential shortly. Here, the PE can sometimes take small ownership in that firm and generally does so through market deals and transactions.

3. Venture Capital Investments for Startups

Venture capital is always a good way for startups to get funds as they are the ones that allow a startup to stay afloat and get customers, which is effective for the business to run and finally get towards profitability.

These are the Pes where they pick certain sectors and invest in those startups that are in the new frontier and are at a growth stage in the near term and can become very big in a long-term perspective. They have San Diego, California, tax attorneys, and other lawyers also who can do the contract for the PE and the potential businesses.

4. PEs Specialized in Distressed Investments

Finally, certain PE funds specialize in investing in those businesses that are on the verge of bankruptcy, and through that, they can take the controlling stake. They can either break the business or kickstart the company depending on the type of industry the business operates.

Need for the PE Funds

- Helps a business to raise funds.

- Works with multiple companies in M&As.

- Helps to get new deals.

- A PE firm can conduct better due diligence.

- A role in managing portfolio for its investors.