What Are Debt Consolidation Loans and How Do They Function?

Why do so many individuals seek ways to manage multiple financial obligations? Is there a smarter approach to gaining control of scattered repayments? A consolidation strategy can simplify finances and reduce stress for those overwhelmed by various payments. But how exactly do these financial tools work, and are they the right solution?

Understanding the Basics of Debt Consolidation Loans

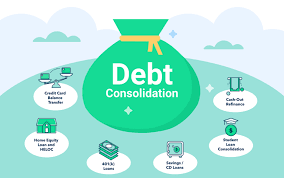

At its core, a debt consolidation loan combines several debts into a single payment. This often involves taking out one larger loan to pay off smaller debts, which may have higher interest rates. For example, a secured debt consolidation loan may use collateral, like a home, to offer a lower interest rate.

This strategy makes managing finances easier by replacing multiple due dates with one. It also simplifies budgeting, as individuals know exactly how much they owe each month. Moreover, it helps reduce the risk of missed payments, which can protect credit scores and avoid late fees.

How Do They Help Manage Finances?

Consolidation loans simplify the repayment process by combining multiple financial obligations into a single payment. This eliminates the hassle of managing multiple creditors. It allows borrowers to focus on their financial commitments without the confusion of juggling different due dates and amounts.

A key advantage is that the single payment often has a fixed interest rate. This stability provides predictability, enabling borrowers to plan their finances more effectively and avoid the uncertainty of fluctuating costs. By streamlining payments and offering consistent terms, consolidation loans present a practical solution for individuals seeking to regain control of their financial situation. They also help work toward long-term stability and peace of mind.

Key Benefits

Lower Interest Rates

- Consolidation loans often offer lower interest rates compared to high-interest credit cards and other obligations.

- This reduction can significantly lower overall borrowing costs, making repayment more affordable over time.

Simplified Repayment Process

- With just one creditor to pay, managing repayments becomes much easier.

- This reduces the risk of missed deadlines or late fees, streamlining financial management.

Reduced Financial Stress

- Borrowers no longer need to juggle multiple due dates and varying amounts.

- This simplified approach alleviates stress and allows individuals to focus on achieving financial stability.

Who Is Eligible for a Consolidation Loan?

Eligibility for a consolidation loan is determined by several factors, including a borrower’scredit history, income level, and the total amount owed. Lenders carefully assess an applicant’s ability to make consistent and timely repayments before approving the loan. Individuals with strong credit scores are typically offered favourable terms, such as lower interest rates and more flexible repayment options.

On the other hand, borrowers with lower credit scores may still qualify but will likely face higher interest rates and stricter conditions. Borrowers need to explore all available options. They should compare terms and benefits to find a plan that best aligns with their financial circumstances and goals.

Secured vs Unsecured Options

Borrowers can choose between secured and unsecured loans when considering a consolidation strategy. A secured debt consolidation loan requires collateral, such as property or other valuable assets, to secure the loan. This arrangement often provides the advantage of lower interest rates, making it more cost-effective in the long term. However, the borrower risks losing the collateral if repayments are not met.

On the other hand, unsecured loans do not require any collateral, but they typically come with higher interest rates. This makes them potentially more expensive but less risky in terms of asset forfeiture. Choosing between the two depends on an individual’s financial situation, long-term goals, and willingness to accept certain risks. Understanding these differences is essential for making a well-informed decision.

A secured debt consolidation loan can be a game-changer for those struggling with multiple obligations. By combining payments into one, borrowers simplify their financial lives and potentially reduce overall costs. While eligibility and terms vary, taking the time to research options can lead to better outcomes. For individuals ready to take control of their finances, this type of loan represents a practical and effective solution.